In the U.S., 26 is the age where we all have to leave our parent’s insurance plans and have to essentially figure things out for ourselves. So where exactly does

Let’s start with this…it’s the LAW! Most states require drivers to carry some type of car insurance to prove that you can pay for potential accident expenses. Even if your

During the winter months, homeowners’ insurance claims tend to skyrocket. Repairs are costly, so it’s best to do whatever is possible to avoid common winter claims. One of the most

Cash back rates through credit cards have skyrocketed in recent years, and Amazon’s latest 5 percent card is just feeding into the trend. Issued through Chase, Amazon has released its

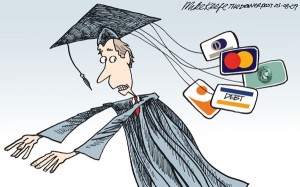

Heading off to college, it may be hard to go in healthy credit habits, especially if you’ve never had a credit card or anything before. Here are a few tips.

As spending increases, consumers are looking for ways to increase their savings as well. One way to help this is finding a credit card that offers cash back savings opportunities.

As expected, those with lower credit are often the ones who need a credit card or loan to assist them the most. Yet with a score below 600, it’s often

Whether you’re trying to buy a house or rent an apartment, your credit score is an incredibly important aspect of those big life moments. Here are some fun, interesting facts

Approximately 99.95 percent of small businesses try to take advantage of debt financing. In doing so, it’s imperative that these companies and business owners understand what goes into acquiring a